Balancing Financial Stability During a Career Change

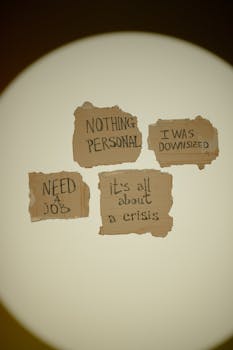

Switching careers can feel both exhilarating and daunting, especially when your finances are on the line. It’s like standing at the edge of a pool, deciding whether to jump in or play it safe. Many worry that taking the leap might mean sacrificing their financial health in pursuit of something more fulfilling.

Your financial stability isn’t just about paychecks; it’s about ensuring peace of mind while navigating the unknown. As people look for more meaningful work or new challenges, the financial side of change often causes the most anxiety. However, preparation and strategy can ease the transition and limit stress.

This guide breaks down effective ways to balance your finances during a career shift. If you’re considering that leap or simply want to prepare, these insights offer practical steps, real-world examples, and tips that make managing your finances during change less overwhelming.

Assessing Your Current Financial Picture

Before you chart a new career path, understanding your current financial status is crucial. Think of it like checking your gas tank before a long road trip—you wouldn’t get far if you ran empty halfway to your destination.

Imagine your finances as a garden. If you know which plants are thriving and which need extra care, you can nurture a healthier space. Similarly, knowing your assets, debts, and spending habits empowers smart decision-making.

- Calculate your total monthly expenses, including housing, food, insurance, and transportation, to establish where your money goes each month.

- List all sources of current income, from wages to side gigs and investment returns, for a complete view of incoming funds.

- Take stock of your savings and emergency funds, ensuring you have a safety net if any unexpected costs arise during your career change.

- Document any outstanding debts, such as credit cards or student loans, to understand your financial obligations.

- Analyze discretionary spending patterns, like dining out or subscriptions, which can be adjusted if needed to balance your budget.

- Review regular savings contributions or investments to assess whether you can maintain them during the transition.

A clear financial picture gives you confidence to plan ahead. By knowing exactly where you stand, you can identify opportunities for savings and areas where you might need to tighten spending in the short term.

Building a Transition Budget You Can Trust

Lindsay decided to leave her steady corporate job and pursue teaching—a drastic shift, especially for her bank account. Her first move was to set up a budget that could weather the storm. It wasn’t about perfection, but preparation.

When Kevin made a similar switch, he learned the hard way that underestimating expenses led to scrambling in the middle of the month. His new budget included wiggle room for those unpredictable costs and gave him peace of mind.

Having a flexible but realistic transition budget is like packing your suitcase for a long trip. You can’t plan for every scenario, but giving yourself backup supplies makes the journey less stressful.

A well-built budget means mapping all known income and expected expenses, and adjusting discretionary spending. If you know your rent, groceries, and transportation are covered, that cushion will help you focus on your new path.

Taking time to create your transition budget can make or break your experience. With a plan, you avoid panic-driven decisions and enjoy greater control, letting you concentrate on career growth instead of mounting bills.

Smart Ways to Stretch Savings While Switching Careers

Carefully managing your savings during a career transition requires creativity and strategic planning. Think of it as rationing supplies on a cross-country drive, stretching every dollar to get further and stay on track.

- Set clear spending limits: Compare several months’ expenses and find areas to reduce, such as eating at home more often or pausing larger non-essential purchases during your transition.

- Automate savings: Transfer a set percentage of income into your emergency fund or savings account before you spend, helping you stay disciplined and avoid accidental overspending.

- Temporarily cut non-essential subscriptions: Pause streaming services, gym memberships, or magazine subscriptions, so funds are available for necessities as you adapt to a new financial reality.

- Negotiate temporary payment relief: Contact lenders and service providers to explore reduced payments, hardship options, or deferrals during your job switch for added financial flexibility.

- Pursue side gigs or freelancing: Supplement income with temporary work or gig opportunities so you aren’t forced to drain your primary savings to cover basic needs and bills.

- Sell unused items: Unclutter your space and generate extra cash by selling clothing, electronics, or furniture online, reinvesting those funds into your transition budget.

- Re-evaluate insurance needs: Shop for alternative insurance plans or temporary coverage to potentially lower monthly premiums while maintaining essential protection during this period.

Each step above offers a unique way to stretch your resources, adapt to change, and reduce stress while your new career foundations solidify.

Short-Term Sacrifices Versus Long-Term Rewards

Some sacrifices may feel uncomfortable at first, but keeping your eyes on long-term goals helps you persevere. For instance, staying in a smaller apartment or giving up luxury expenses may seem like a step back but can lead to greater stability later on.

Consider the scenario where Alex rented out a room in his house. Though privacy took a hit in the short term, this move ensured he didn’t dip into savings during his retraining. Such choices present an immediate tradeoff for extended financial health.

| Short-Term Sacrifice | Financial Impact | Long-Term Reward |

|---|---|---|

| Downgrading car or using public transit | Lower monthly payments, reduced fuel and insurance costs | More savings and less debt accumulation |

| Postponing vacations | Immediate cash flow preservation | Funds available for professional development or emergencies |

| Cutting gourmet coffee or dining out | $50–$150 saved per month | Building larger emergency savings faster |

While sacrifices vary for everyone, the table above illustrates common options that trade short-term comforts for lasting benefits. These strategic adjustments offer both immediate and future stability during your career shift.

Identifying Support Systems for Financial and Emotional Health

Transitioning careers isn’t a solo adventure—friends, family, and community groups play key rolls. Like a relay race, passing the baton between supportive teammates helps you reach the finish line in better shape.

Seeking advice from others who’ve shifted careers can offer practical encouragement. For example, a peer group or mentor might share insights on maintaining discipline, or direct you to helpful financial resources.

Online forums and social media groups, when used thoughtfully, provide space to exchange ideas, ask questions, and troubleshoot challenges. Sometimes a virtual cheerleader or accountability partner makes all the difference in staying on course.

Career counselors and financial advisors bridge gaps in knowledge. They can assist you in making sense of tangled budgets, complex benefits options, or mental roadblocks. Their experience accelerates learning and minimizes mistakes.

Combining social and professional support ensures your emotional wellness and financial resilience go hand in hand, making your career change less overwhelming and more rewarding overall.

Sustaining Momentum with Productive Habits

- Track expenses daily for an accurate financial picture

- Set small, achievable weekly savings goals

- Have regular family or partner check-ins about finances

- Use reminders for bill payments to prevent late fees

- Log networking activity and progress toward job search milestones

- Schedule downtime to avoid burnout from constant change

- Celebrate small wins to build confidence

Habitual actions reinforce progress. Tracking spending—even with a simple notebook or app—reveals where hidden leaks might drain your resources during the transition.

Weekly savings goals and structured check-ins create accountability, so decisions aren’t made in a vacuum. Having these systems in place preserves both relationships and finances, encouraging open communication and shared responsibility.

Weighing Outcomes: Comparing Possible Scenarios

Imagine you stick with your original job for stability, but the lack of fulfillment leaves you stressed. Alternatively, you switch careers, take a salary dip, and manage your finances carefully—ultimately feeling happier and more in control.

Some find that cautious planning—a transition budget, reduced spending, and leveraging side gigs—lets them thrive, even with a temporary pay reduction. Others risk taking the plunge without preparation and face unnecessary hardship or the need to return to their old path.

On the other hand, planning too rigidly and never pursuing new roles can stifle personal and career growth. Balancing due diligence with a willingness to adapt can open opportunities without risking your financial foundation.

Conclusion: Navigating Change, Securing Stability

Taking a career leap is never easy, but thoughtful preparation gives you solid ground to land on. A clear view of your finances and a realistic budget turn worry into action.

Temporary sacrifices pay off when they’re paired with long-term dreams. By setting habits, using support networks, and staying adaptable, you’re crafting a toolkit for success rather than relying on luck.

Comparing outcomes helps you make informed choices—embracing both the risks and rewards. No two journeys look the same, but lessons from others can illuminate your path.

Ultimately, career changes are about more than paychecks—they’re investments in your future. With structure, awareness, and determination, you can achieve not just stability, but the satisfaction that comes from living a life on your own terms.